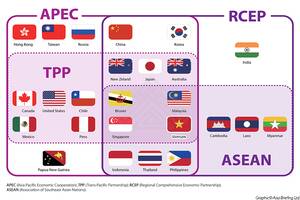

- It is important for foreign investors to understand ASEAN’s free trade agreements (FTAs) to capitalize on the bloc’s long-term potential.

- These FTAs offer numerous benefits such as tax holidays, improved custom clearances, and reduced import costs.

ASEAN could become the world’s fourth-largest economy by 2030, comprising of a consumer market valued at over US$4 trillion.

This economic achievement will be driven by four major forces: strong demographic trends (65 percent of ASEAN’s 600 million population will be middle-class), increasing foreign investment, rising income levels, and digital advances.

Strengthening the bloc’s continued growth trajectory is its various free trade agreements (FTAs) some of which are the world’s largest. These FTA offers numerous opportunities for foreign investors, ranging from capitalizing on Singapore as the region’s financial services hub or moving manufacturing operations to low-cost regions in Vietnam, Indonesia, and Malaysia.

International businesses can benefit from ASEAN’s FTA network in the form of reduced importer costs, improved custom clearances, and increased access to products eligible for preferential treatment. Moreover, there are numerous tax and fiscal benefits such as tax holidays and deductions.

ASEAN-Australia-New Zealand Free Trade Area

The ASEAN-Australia-New Zealand Free Trade Area (AANZFTA) came into force in January 2010 and currently eliminates 90 percent of goods traded between ASEAN, Australia, and New Zealand. The FTA covers approximately a population of 653 million and over US$4.3 trillion.

The agreement will be fully implemented in 2025, by which time, almost all trade between ASEAN states, Australia, and New Zealand will be tariff-free.

In 2019, signatories to the FTA were in discussions to upgrade the agreement so as to develop rules in modern trade policy areas as well as address remaining issues.

The parties have focused on reviewing these key trading areas:

- Trade-in Services — Review services commitments taking into account recent progress between members;

- E-commerce — Review the e-commerce chapter to take into account developments within the industry since the implementation of AANZFTA;

- Rules of origin (ROO) — This is a review of the ROO text to take into account modern-day practices including;

- A trade facilitating documentary evidence of origin system; and

- Transit arrangements that reflect modern hubbing practices.

- Customs procedures — Review the customs procedures chapter to include trade facilitation, particularly provisions of the WTO Trade Facilitation Agreement;

- Government procurement — Develop a chapter to improve transparency and cooperation in government procurement;

- Trade and sustainable development — Develop further cooperation in this field between members;

- Competition — Review the chapter to include new provisions on consumer protection; and

- Investments — Review and finalize texts, taking into account progress in other FTA processes.

ASEAN-China Free Trade Area

The ASEAN-China Free Trade Area (ACFTA) was signed in 2004 and was implemented in July 2005.

Through this FTA, China has consistently ranked as ASEAN’s largest investor over the last decade, with total trade of over US$731 billion in 2020.

The FTA reduced tariffs on more than 7,000 product categories — or 90 percent of imports — to zero by 2010, although initially only applicable to Indonesia, Malaysia, Singapore, Brunei, the Philippines, Singapore, and Thailand. The remaining ASEAN members (Myanmar, Laos, Vietnam, and Cambodia, followed suit in 2015.

In 2019, ACFTA was upgraded to simplify rules of origin (ROO), trade facilitation measures, investment procedures, and customs procedures.

Under the amendment, there are multiple ways in which the ROO is decided:

- The origin of the goods is deemed according to the country they were produced or obtained;

- However, if the goods were obtained from multiple countries, the regional value content (RVC) must be at least 40 percent of the value of the goods, and the final process of production must be done in a country that is a member of the FTA; and

- Various Product Specific Rules was introduced to clarify goods that have undergone significant transformation in the tariff classification or supply chain.

In Q1 2020, ASEAN overtook the EU to become China’s largest trading partner, increasing year-on-year to US$140 billion and accounts for 15 percent of China’s total trade volume. This comes as China’s traditional largest trading partner, the EU, went under extensive lockdown.

Electronics were the biggest contributor to this trade, with China importing US$14.9 billion worth of integrated circuits, such as microprocessor chips, analog-to-digital converters, and chip capacitors from ASEAN countries.

ASEAN-India Free Trade Area

The ASEAN-India Trade Area (AIFTA) entered into force on January 1, 2010. The signing of the agreement paved the way for the creation of one of the world’s largest free trade area market, creating opportunities for over 1.9 billion people in ASEAN and India with a combined GDP of US$4.8 trillion.

The agreement set tariff liberalization of over 90 percent of products, especially for certain products such as palm oil, pepper, black tea, and coffee.

Exports from India to ASEAN reached US$31 billion for the 2019-2020 period while Indian imports from ASEAN reached US$55 billion.

India and ASEAN have agreed to review the scope of the FTA in order to address certain barriers to trade, namely tariffs. India is treated differently to other ASEAN trade partners as it does not have an economic agreement with the bloc. For instance, Japanese car imports face a five percent duty in Indonesia and Thailand while a 35 percent tariff is imposed on Indian automobiles.

There are opportunities in areas such as generic drug production and medical devices. India is the world’s largest provider of generic medicines and supplies some 62 percent of global vaccines.

ASEAN-Republic of Korea Free Trade Area

The ASEAN-Republic of Korea Free Trade Area (AKFTA) came into force in 2007 and sets out preferential trade arrangements between ASEAN member states and South Korea.

Tariff elimination for 90 percent of products traded between South Korea and ASEAN members Brunei, Indonesia, Philippines, Malaysia, and Singapore were scheduled in 2010, whereas tariff eliminations for Vietnam, Laos, and Myanmar were scheduled by 2018.

South Korea’s combined exports to all 10 ASEAN members reached over US$80 billion in 2019, with two-way trade reaching US$160 billion. South Korea and ASEAN made a pledge to increase this to US$200 billion during a summit in Busan to mark 30 years of ties.

This came two years after Seoul launched its New Southern Policy which aims to better cultivate relations with ASEAN and India as important partners in the southern region. For ASEAN, greater economic ties with South Korea could help the bloc diversify its economic interests, particularly away from China.

ASEAN-Japan Comprehensive Economic Partnership

The ASEAN–Japan Comprehensive Economic Partnership (AJCEP) came into force in December 2008, covering trade in services, goods, investments, and economic cooperation.

Tariff eliminations for the ASEAN-6 and Vietnam were completed some 10 years from the entry into force of the agreement, and the rest of ASEAN three years or so after.

The FTA provides for the elimination of duties on 87 percent of all tariff lines and includes a dispute settlement mechanism. It also allows for back-to-back shipment of goods between member countries, third party invoicing of goods, and ASEAN cumulation. Both ASEAN and Japan have also initiated several economic cooperation projects that include capacity building and technical assistance in areas of mutual interest. These areas include intellectual property rights, trade-related procedures, information and communications technology, human resources development, small and medium enterprises, tourism and hospitality, transportation and logistics, among others.

In August 2020, Japan its ASEAN partners that it had completed the legal procedures to amend the First Protocol of the AJCEP, which included certain provisions that were not contemplated in the 2008 version.

This revision will allow for more cross-border investments between Japan and ASEAN which reached over US$214 billion in 2019 and require countries to maintain transparency in regulating services.

It also establishes dispute settlement mechanisms for businesses in regard to possible unfair treatment by the government, in addition to rules on the movements of foreign business travelers. These rules are of particular importance to Myanmar, Laos, and Cambodia who do not have bilateral trade deals with Japan.

Regional Comprehensive Economic Partnership

On November 15, 2020, ASEAN signed the Regional Comprehensive Economic Partnership (RCEP) agreement along with Australia, China, Japan, New Zealand, and South Korea.

The RCEP becomes the largest FTA in history, covering roughly 30 percent of global GDP (US$26 trillion) and 30 percent of the world’s population. The agreement could add US$186 billion to the global economy as well as 0.2 percent to the GDP of its members.

Under the FTA, tariffs will be eliminated on 92 percent of goods over the next 20 years, in addition to consolidating ROO definitions among participating nations. Businesses will thus only require one certificate of origin for trading in the region.

Some 65 percent of the service sector will be open to foreign investors, raising the ceiling for foreign ownership in various industries such as financial services, telecommunications, and professional services.

The RCEP will motivate more investment through the China+1 strategy to lower-cost members of the FTA such as Cambodia, Myanmar, Indonesia, and Vietnam for more labor-intensive processes, such as in garment manufacturing.